In Kenya, a KRA PIN (Personal Identification Number) is more than just a tax requirement — it’s your key to accessing essential services. Whether you’re opening a bank account, applying for a job, buying land, importing goods, or starting a business, your KRA PIN is mandatory.

As of 2025, with government digitization efforts, the Kenya Revenue Authority (KRA) has streamlined the registration process through its iTax portal. In this guide, we’ll walk you through how to register for a KRA PIN, what you need, and how to solve common problems people face in the process.

2. Who Needs a KRA PIN?

You need a KRA PIN if you are:

- A Kenyan citizen aged 18 and above

- A foreign resident with a work permit or investor status

- A company or organization operating in Kenya

- Anyone involved in:

- Formal employment

- Business operations

- Import/export

- Vehicle registration

- Applying for government tenders

- Buying or selling property

- Bank and M-Pesa account opening (in some cases)

👉 Simply put, if you’re making money or engaging in formal transactions in Kenya, you need a KRA PIN.

3. Documents Required for KRA PIN Registration

Before beginning the application, ensure you have the following:

Kenyan Citizens:

- National ID (ID card number)

- Active email address

- Working phone number

For Foreign Residents:

- Alien ID or Passport

- Work permit or valid immigration documents

- Email address and phone number

For Companies:

- Certificate of Incorporation (CR12 for Directors)

- Company email and contact info

- Directors’ KRA PINs and ID numbers

💡 Tip: Make sure your email address is accessible, as activation links and PIN notifications are sent there.

👉 Download KRA PIN Registration Checklist – 2025

4. Step-by-Step: How to Register for a KRA PIN on iTax (2025)

Follow these steps to register:

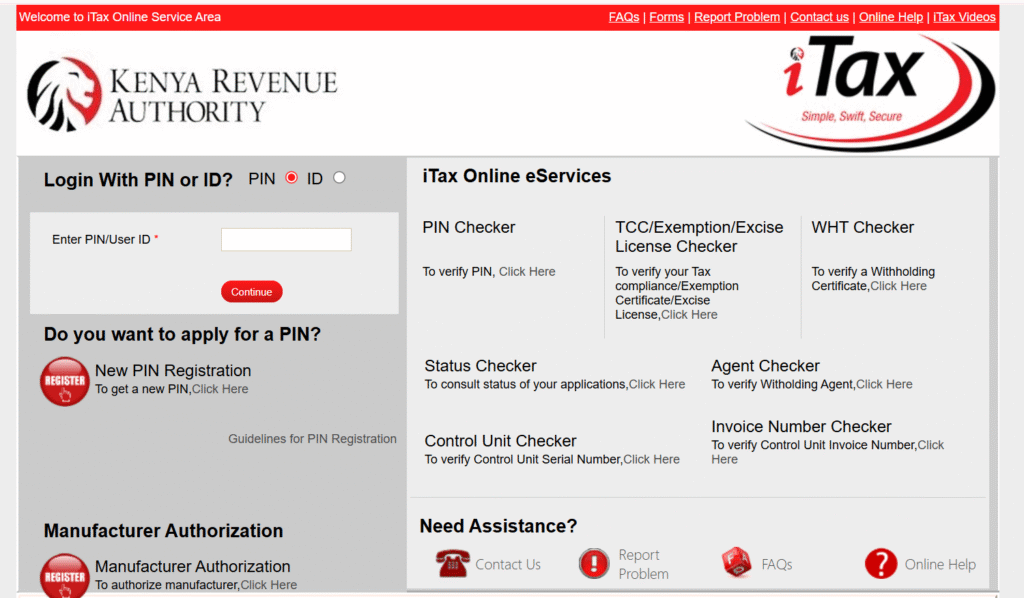

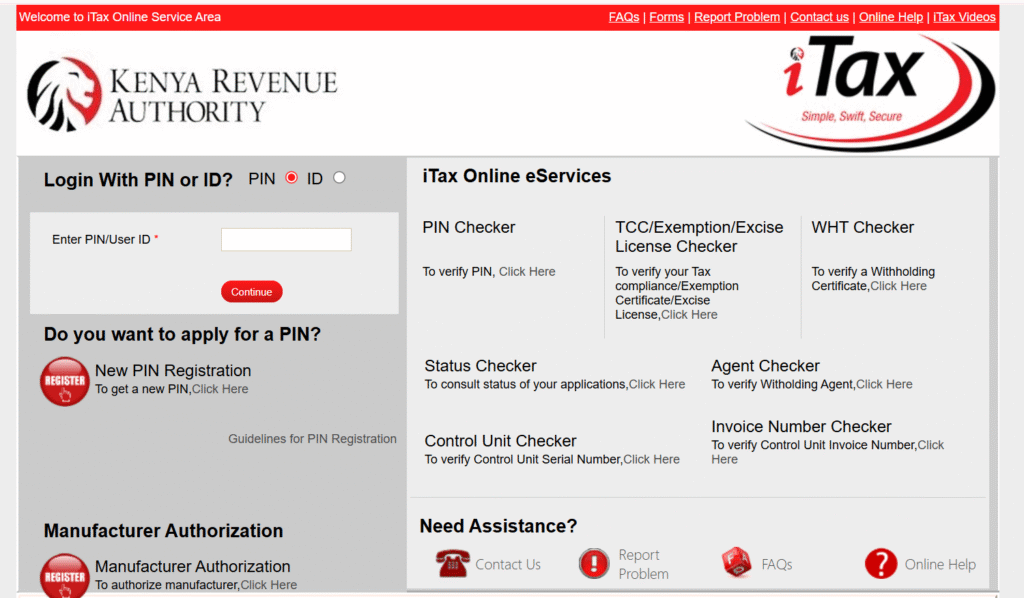

- Go to the official iTax portal:

https://itax.kra.go.ke - Click “New PIN Registration” under the “Register” section.

- Select your taxpayer type:

- Individual

- Non-Individual (Company, Partnership, etc.)

- Fill in personal details:

- Name, ID number, date of birth

- Contact info (email, phone)

- Employer details (if employed)

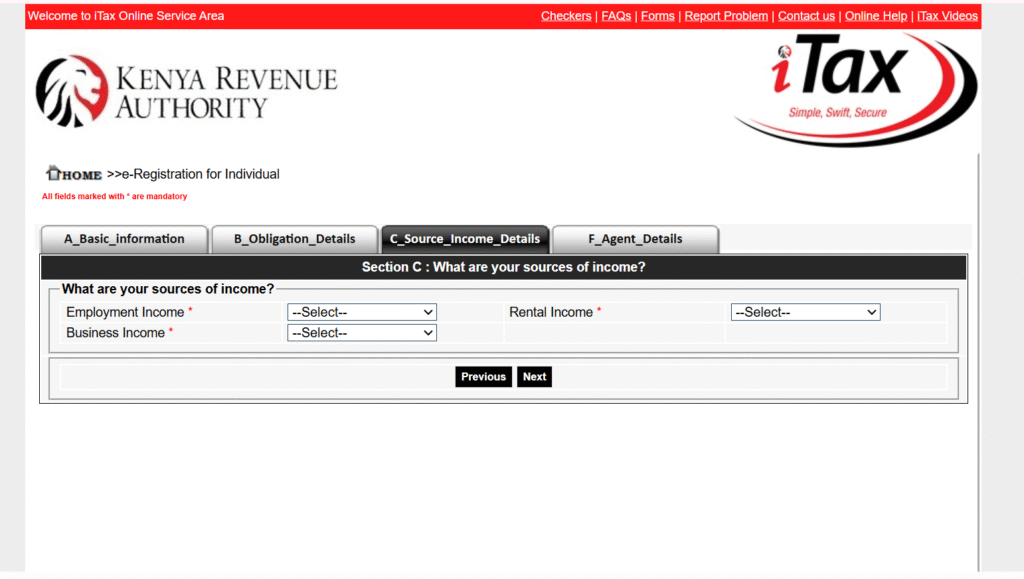

- Choose your tax obligation:

- Income tax (resident/non-resident)

- Value Added Tax (VAT) if applicable

- Submit and verify your email:

You’ll receive a PIN certificate via email upon successful registration.

🛠️ Make sure to save and print your PIN certificate — you’ll need it often.

5. Common Issues and How to Solve Them

Here are common challenges people face and how to fix them:

- Email not receiving PIN certificate?

Check your spam/junk folder or confirm your email address is active. - Forgot your KRA PIN?

Use the “Forget PIN” option on iTax or contact the nearest KRA support center. - Registration errors?

Avoid special characters in your name, use the correct format (e.g., +254 for phone), and ensure all mandatory fields are filled. - Error: ‘PIN already exists’

You may already have a PIN. Try retrieving it or contact KRA for help.

✅ Bluxel Africa offers PIN registration assistance — reach out if you get stuck.

8. How to Register a KRA PIN for a Company or Business

For companies and business entities, the process differs slightly:

- Have the following ready:

- Certificate of Incorporation (for registered companies)

- Business Registration Certificate (for sole proprietors)

- Director(s)’ KRA PINs and ID copies

- Company email and phone number

- KRA PIN of the person handling taxes (e.g., accountant or agent)

- Go to iTax, and choose “Non-Individual” registration.

- Complete the online form with business details, attach necessary documents, and submit.

You will be issued a Business KRA PIN, which is mandatory for tax filings, opening a business bank account, and engaging in public procurement.

9. Common Challenges & Mistakes to Avoid

Even though the process is straightforward, these are the pitfalls many applicants face:

⚠️ Using someone else’s phone number or email—always use your own.

⚠️ Misspelling names or dates that don’t match your ID—double-check!

⚠️ Submitting incorrect details under employment or business fields

⚠️ Failing to download your PIN certificate after registration

⚠️ Not verifying your email—this is essential for account recovery

If you’re stuck or unsure, it’s better to ask a tax consultant or visit a Huduma Centre.

10. FAQs About KRA PIN Registration

Q: Is KRA PIN registration free?

Yes, registration is 100% free of charge.

Q: Can I apply for a PIN without a job?

Yes, select “Unemployed” in the income source section.

Q: How long does it take to get the PIN?

Instantly, if all your details are correct.

Q: Can I use a cyber café or agent to help me register?

Yes, but always make sure they are credible or registered.

Q: What is the minimum age to apply for a KRA PIN?

18 years for individuals. Anyone employed, in business, or above 18 should register.

11. Final Thoughts

Registering a KRA PIN in Kenya is no longer a complicated, intimidating process. Whether you’re a student, job seeker, business owner, or just need a PIN for compliance purposes, following the steps above ensures you’re fully prepared and informed.

🚀 At Divas College, we offer FREE assistance with KRA PIN registration and other government digital services. If you need help:

📞 Call or WhatsApp us: 0115 690 990

🌐 Visit: Divas Technology College

📍 Or walk into our office in Kilifi for face-to-face support.

👉 Download KRA PIN Registration Checklist – 2025

Let us handle the stress—so you can focus on what matters. 🙌